|

|

| Making learning and work count Labour market LIVE from Learning and Work Institute 15 September 2020

Learning and Work Institute comment |

|

| Chart 1: Jobseeker’s Allowance and Universal Credit claimant count The ONS headline Jobseeker’s Allowance and Universal Credit claimant count has risen by 73,734 in August, taking the total to 2,737,945. ONS' claimant count before seasonal adjustment rose by 84,536 to 2,735,382. This change is directly comparable to the local level claimant count changes published today.  |

|

| Chart 2: UK unemployment (ILO) - the official estimate The latest unemployment figure is 1,398,000. It has risen by 60,000 from the figure published last month. The preferred quarterly comparison is up by 62,000. The unemployment rate rose by 0.2 percentage points to 4.1% - both over the month and the quarter.  |

|

| Chart 3: Youth unemployment The number of unemployed young people has risen by 20,000 since last month’s figures, to 563,000. Meanwhile, the number of young Universal Credit or Jobseeker’s Allowance claimants last month by 562, to 526,352. There are now 146,000 more young claimants of Universal Credit or Jobseeker's Allowance than the number of unemployed young people who are not in education.  |

|

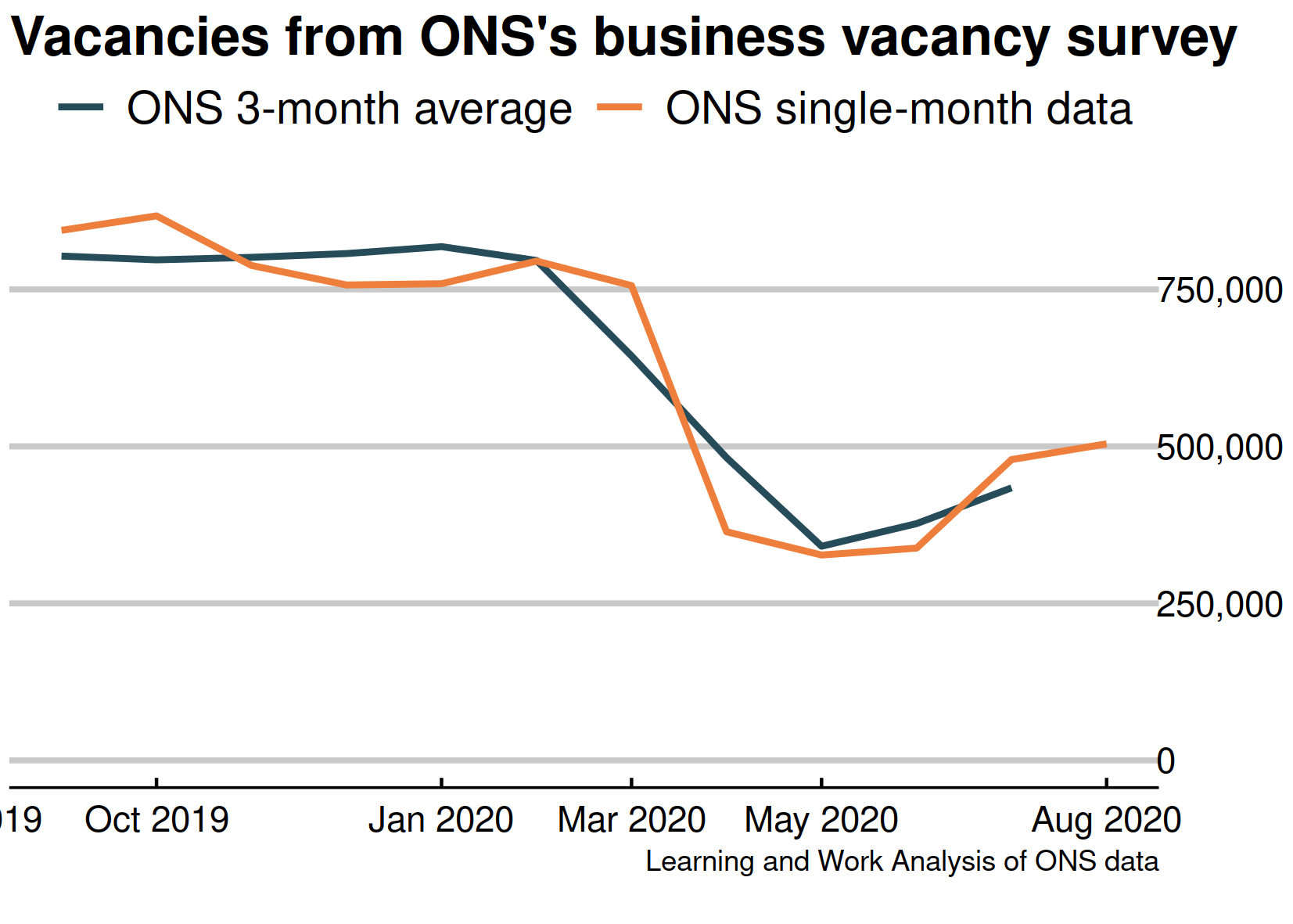

| Chart 4: Vacancies – whole economy survey Headline vacancies recovered very slightly this month, to 434,000. The ONS' experimental single-month vacancy figures shows a more substantial recovery from 327,000 in May, to 504,000 in August. The headline ONS vacancy figure is both seasonally adjusted and a three-month average. The chart shows both series.  |

|

| Chart 5: Experimental single month vacancies – whole economy survey The Office for National Statistics experimental single month vacancy estimates include sectoral information. As these are not seasonally adjusted, it is better to look at annual changes.  |

|

| Chart 6: Unemployment rates by age The 18 to 24 year old unemployment rate (including students) is 12.3% of the economically active – excluding one million economically inactive students from the calculation. The rate for those aged 25 to 49 is 2.9%. For those aged 50 and over it is 2.6%. The quarterly change is up 1.6 for 18 to 24 year olds, up 0.1 for 25 to 49 year olds, and up 0.1 for the over-50s.  |

|

| Chart 7: Young people not in employment, full-time education or training The number of out of work young people who are not in full-time education (1,023,000) has fallen in the past quarter by 3,000 , or 0.3%, but remains high.  |

|

| Chart 8: UK employment Employment increased by 55,000 on the figure published last month, to 32,979,000. The preferred quarterly comparison was down by 12,000 (on February to April).  |

|

| Chart 9: Employment rate in the UK The employment rate is up by 0.1 percentage points over the quarter, to 76.5%.  |

|

| Chart 10: Claimants for inactive benefits and the economically inactive – inactivity benefits The number of people inactive owing to long-term sickness fell sharply, while the latest benefit figures (for February 2020) rose. This chart shows claimants of Employment and Support Allowance, and Incapacity Benefit (the orange dots), compared with survey figures for the economically inactive owing to long-term sickness. Survey responses as to the reasons for inactivity may be volatile at the moment.  |

|

| Chart 11: Claimants for inactive benefits and the economically inactive – lone parents This chart shows claimants of out of work benefits as lone parents (the orange dots) and survey figures for all those who are economically inactive looking after family (including couple families). The survey figures (showing those looking after family) fell sharply while benefit measures continued to fall in the latest (February 2020) data.  |

|

| Chart 12: Employment rates in regions – May 2020 to July 2020 Compared to last year, six regions showed a rise in the employment rate, while five showed a fall. The largest rises were in the North east and London, and the largest falls were in the South West and Eastern regions.  |

|

| Chart 13: Unemployment rates in regions – May 2020 to July 2020 Compared to last year, eight regions showed a rise in unemployment, while four showed a fall. The largest rises were in the South West, Scotland and Eastern England. The largest falls were in Wales and the North West.  |

|

| Chart 14: Inactivity rate quarterly change in regions – May 2020 to July 2020 Compared to last year, six regions showed a rise in the inactivity rate, led by the South West and Wales, while six showed falls, led by the North East and London.  |

|

|

This newsletter is produced by Learning and Work Institute and keeps readers up to date on a wide range of learning and work issues. |

|